SPACS, the New Investment Trusts that Were Part of the 1929 Crash

Investment Trusts were first introduced in the U.S. around 1926, in the form of trading corporations, with the sole purpose of investing pooled capital into stocks. And like many new investment…

Selling Volatility

Selling volatility is a unique way to enhance portfolio returns. We have been doing this for years by selling puts in stocks we would want to buy. The way we accomplish this is fairly simple. We…

Rule #1 Don't Lose Money Rule #2 Don't Forget Rule #1

This may be the most famous of all of the famous Buffett aphorisms. With his dry sense of humor, Buffett Says Rule #1 Don't Lose Money, then he quips, Rule #1 Don't forget rule #1. One of the things…

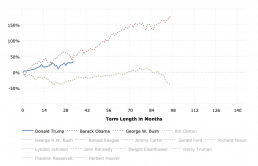

S&P 500 Performance by President | MacroTrends

Impeachment,Democrats, Republicans- how will it all play out in the markets? This app by MacroTrends shows you what happened in the past. “History doesn't repeat itself but it often rhymes,” as Mark…

Simple Guide to…

Simple Guide to…