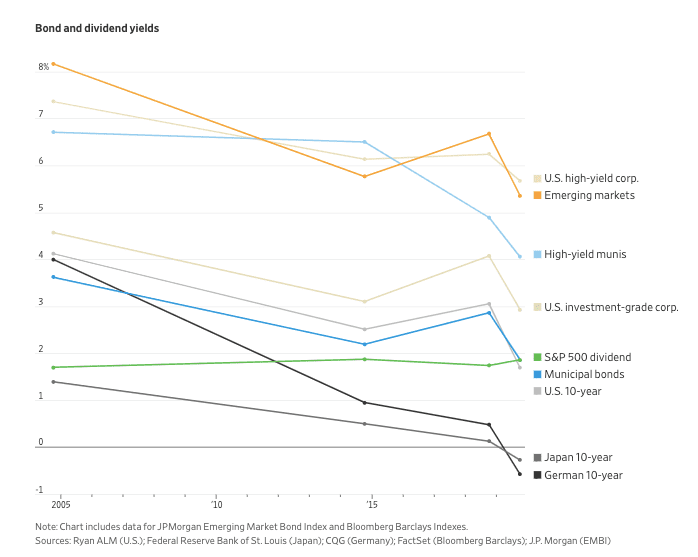

A recent article in the Wall St Journal and the accompaning picture stood out like a sore thumb. While investors are wrestling with historic low yields on government and corporate bonds, “Investing in a Low-Yield World,” there is ample opportunitty in the stock market to invest in companies with double digit yields. The irony was striking.

The author wrote, Ira Iosebashvili wrote on Sept. 30th, the world is again running low on yield.Around $15 trillion in government debt globally now has negative yields, meaning investors are paying for the privilege of parking their money with a sovereign issuer. And while yields in the U.S. remain positive, they nosedived in the third quarter.

We’ve put together a list of stocks that corporate insiders have been buying that have an average yield of 9.5%. Insiders, most specifically C-Level officers and directors, have a better understanding of their business than the general public. High dividends are usually a result of deteriorating financial performance but in some cases, the market greatly misprices the opportunity in the short term. The best way to capture this anomaly is by carefully analyzing what insiders are doing. Not only can an investor reap high dividend income but as the market reprices the risk, substantial upside capital appreciation is available. Along with higher income, investors should expect greater volatility and risk.

For a free no-obligation copy of this report contact us at AlphaWealthFunds.com/highyield

Source: Investors Scramble for Yield as Growth Outlook Darkens – WSJ