Alpha is most likely found in emerging hedge fund managers. Emerging fund managers are considered funds under a certain asset level, and they have many more opportunities to move the needle than giant funds. Large asset managers, sophisticated high net worth investors and family offices are seeking alpha & that is what our hedge funds seek to provide.

Warren Buffett, himself, would be the first to tell you he could do more with less. The returns of the early years of Berkshire Hathaway far out performed the current ones. Please review the current SEC inflation adjusted qualification fact sheet by clicking here. Please carefully review the suitability of any investement with your advisor and don’t forget the cardinal rule of investing. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

OUR THREE BOUTIQUE HEDGE FUNDS

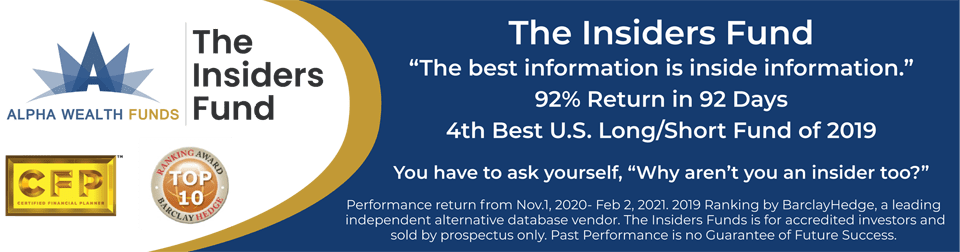

The Insiders Fund is our flagship fund. It is a one-stop, diversified, all-weather long-short fund. The Fund is repeatedly named a best-performing long-short equity fund by BarclayHedge, a leading independent database vendor. The Fund invests in companies at or near prices that management has been willing to invest significant amounts of their money. After all, who knows a business better than those running it? The manager, Harvey Sax, has been deploying it since 2001.

Alpha Low Volatility Fund

Alpha Low Vol, formerly known as Theta Investments, invests in call and put options on the S&P 500 to achieve capital preservation and appreciation in all market conditions. Option buyers typically have negative return expectations. Alpha Low Vol sells options realizing a positive expected return. Alpha Low Volatility aspires to provide market-like returns with just a fraction of the volatility of the market. The Fund is in the process of relaunching with new managers, Chase Thomas and Harvey Sax. Mr. Kellites, the former manager, employs a similar strategy at AlphaCenric and is assisting in the transition.

The Alpha Wealth Volatility Advantage Fund is a long-short equity fund that adds time value to its portfolio through options contract writing and volatility hedges. This fund launched in the Summer of 2018. In its first full calendar year, 2019, the Fund was up 71.2%. The Fund has the ability to make large gains by taking advantage of volatility spikes and high beta stocks. Like its name, it’s not for the faint-hearted as the ups, as well as the drawdowns of the strategy, can be quite significant.

The Alpha Diversified fund focuses on building and maintaining a low volatility, multi-manager hedge fund portfolio that seeks to have low correlation to the broader debt and equity indices.

The fund’s investment objective is capital appreciation with limited variability of returns. The fund attempts to achieve this objective by allocating capital among several pooled entities, each managed by an independent investment adviser who invest in a variety of asset classes.