We all do it but no one does it really well. For most people, It’s just clickbait really. They know there’s a built-in audience that will gobble up anything about the new year. If the past was any guide to the future, we’d all be rich. More than likely what was the worst sector in 2021 will be the best in 2022 and the best will become the worst. That’s the best and most reliable investment advice you’re likely to get.

What started out in 2020 with the Pandemic was a near-universal view that we were in the midst of a major deflationary collapse in demand. The most basic commodity in the world, oil, went briefly negative. Instead, we closed out the year with the highest inflation rate in 40 years.

Here’s my shot at it. The end of 2021 is upon us, so if you’re looking to make investments any time soon, it’s a good idea to start strong with the top investment trends of 2022. Keep reading to get some insight into five trends to look out for in the new year.

Top 5 Investment Trends for 2022

Renewable Energy and Sustainability

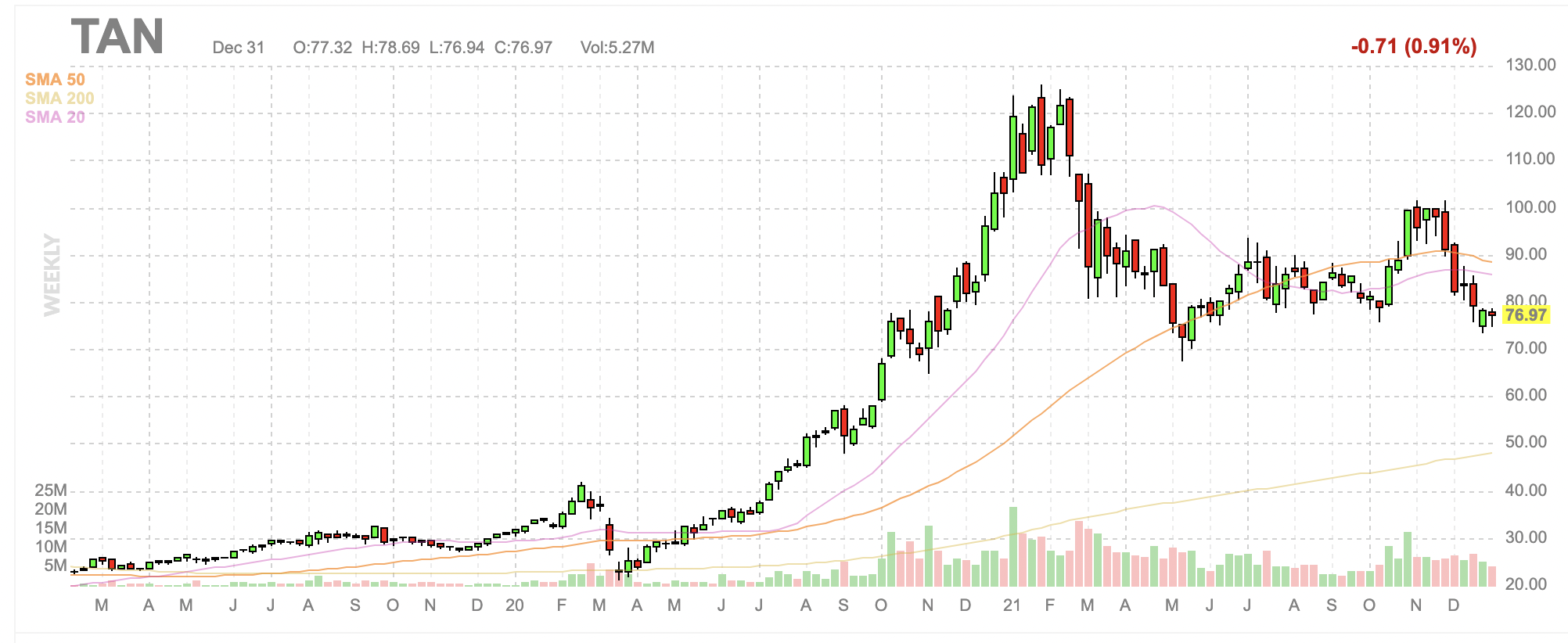

Climate change is looming and pollution is a major global issue, so businesses and governments worldwide are trying to use more renewable energy sources such as wind, solar, and geothermal power. As an investor, you may want to consider expanding your portfolio to include companies that deal with renewable energy, electric vehicles, sustainable agriculture, etc., as their stocks are only expected to grow in value in the next several years. The problem is that many of these stocks have been busts. The largest solar ETF TAN started 2021 at $102.76 and closed it at $76.97. Ouch. One look at the chart below really shows the problem with this. The sector ran up so much in 2020 with anticipation of a Democratic government’s response that 2021 was certain to be a big disappointment. In fact, we got this one right as we wrote that Trump was a big friend of the oil and gas industry but was terrible for stock prices. We predicted the opposite would be the case as Biden made drilling for oil more difficult and prices responded. The energy sector was the best performing sector of 2021 after being the worst in 2020. The Invesco TAN ETF performed so poorly that 2022 could have a good catch-up year.

https://elite.finviz.com/published_idea.ashx?t=TAN&f=010222&i=TANw180740193i

Virtual and Augmented Reality

According to Facebook CEO Mark Zuckerberg, VR and AR technology will begin to play a massive role in our lives, especially in the realms of entertainment, art, and other media. Virtual and augmented technologies are set to become the primary computing platforms in the future, so investors everywhere should set their sights on this industry. Maybe 2022 will be the charm but I wouldn’t bet on it. Other than video game players, surgeons, and some skilled workers that need heads up schematics- it will be a ho-hum year. Samsung showed a VR screen at CES 10 years ago that didn’t need glasses and that has promise but I guess we’re not here yet.

Cryptocurrency

The crypto-craze that started with Bitcoin in the 2010s has transformed into a significant investment opportunity for casual investors and informed investors alike. Bitcoin’s market cap is currently hovering around $1 trillion, a drastic increase from its 2013 cap of about $1 billion. This shows that the crypto frenzy is more than just a passing fad. I’m still waiting for Defi to accomplish something useful. Maybe 2022 will be the year that credit card transaction fees get lowered but based on what I’ve seen from crypto is far from lower fees and faster transactions, just the opposite.

Of course, I’m just jealous because I haven’t made 3500% percent on my bitcoins. Predicting the future of cryptocurrency is beyond my ability, but I’d put money on the under rather than the over. My prediction is that Stable coins and particularly Tether will collapse and it will cause a lot of angst and bleed over into the mainstream financial markets.

Automation

As technology improves, automation will be more and more prevalent in all industries. For example, consumer products such as self-driving cars and home cleaning robots will soon become a part of many people’s daily lives. Additionally, many businesses are constantly looking for ways to automate processes and thus boost productivity while decreasing costs. This is a sure thing but paying for a cheery consensus can cost a pretty price. As consumers and companies turn to automation, the stocks of software and manufacturing companies in this sector will continue to rise.

Meme Stocks

This last trend is a bit less conventional. Meme stocks are stocks that gain traction due to a viral online joke or trend, making the stocks skyrocket.

In 2021, we saw plenty of examples for these kinds of stocks, including AMC and GameStop, which led to significant revenue for some investors. In fact, there have been cases where meme stock prices have grown by 1000%. There was a great cause celeb about the democratization of the markets or whatever that means. I don’t think Meme stocks will rock in 2022 unless shorting them is your sport.

Now, keep in mind that this investment trend shouldn’t necessarily be a part of your long-term strategy due to the volatility and uncertainty of meme stocks. Still, keeping track of fast-growing trends on social media is a must in this digital age.

International Markets– Every year the pundits say this is the year for Emerging Markets. The fact is that the U.S was the best place to be last year and dollars were a good place to be in. With the Fed likely to raise rates in 2022, expect a lot of currency movement and a rising dollar could hurt U.S. exports. If I had to pick one market to invest in besides the U.S, it would be hands down Mexico. The people are friendly, they want to work, and Americans are retiring and moving there in droves for the weather and the much lower cost of living. And guess what- they don’t want to build a wall to keep the Americans out yet.

Wrap Up

As you develop your New Year’s investment strategy, balancing trend-following with secure long-term investments is essential. Keep the above trends in mind and speak with your financial advisor to make the most of your money in 2022. There really was only one bad investment in 2021 and that was cash. Everything else worked splendidly.