Their Causes and How to Prepare

Inflation (the increase in prices of goods and services) is big news lately and a worry for many. However, if it remains in check and not severe, inflation is something that proper financial planning can prepare you for and should not be disruptive to your financial security. In fact, as a Certified Financial Planner, I can suggest many ways to not only plan for inflation but to profit handsomely from it.

So what is going on?

The cause of inflation is something that economists are not always in agreement on. We’ll discuss the main economic theories behind it.

Inflation can be caused due to an increased money supply. For example, a fiscal policy increase in the money supply is accomplished by the government asking monetary authorities to create more of it, diluting its value through increased supply, then giving this new money as a stimulus or bailout. The government borrows more money and injects it into the economy, and they owe it back with interest. If the loan is not paid back, the government must ask to increase the supply (by the amount of interest), thus always borrowing even more with interest and repeating the cycle. This creates ballooning government deficits.

Or, money is created by monetary means, more commonly, by loaning it into existence via the banking system. Through reserve account credits at the fed level, which allows commercial banks to borrow and add to their reserves, which they, in turn, can further loan on secondary markets to increase the total monetary supply.

Inflation Causes

Inflation Causes

Three mechanisms that reduce money’s purchasing power:

- Demand-Pull inflation – The money supply is always a balancing act; if the money supply grows faster than an economy’s ability to create goods and services, demand increases, and prices increase. However, if the store is insufficiently growing, it can decrease production, which raises unemployment.

- Cost-Push inflation – Money is channeled to commodities, especially if they are economically shocked (70’s OPEC crisis), causing intermediate goods’ (energy, steel, flour, transportation) prices to increase, resulting in increased costs for the consumer.

- Built-In inflation – Workers expect current inflation to continue and will demand higher wages to keep up. Resulting in higher costs to purchase goods/services, which all require labor to produce.

What is going on now?

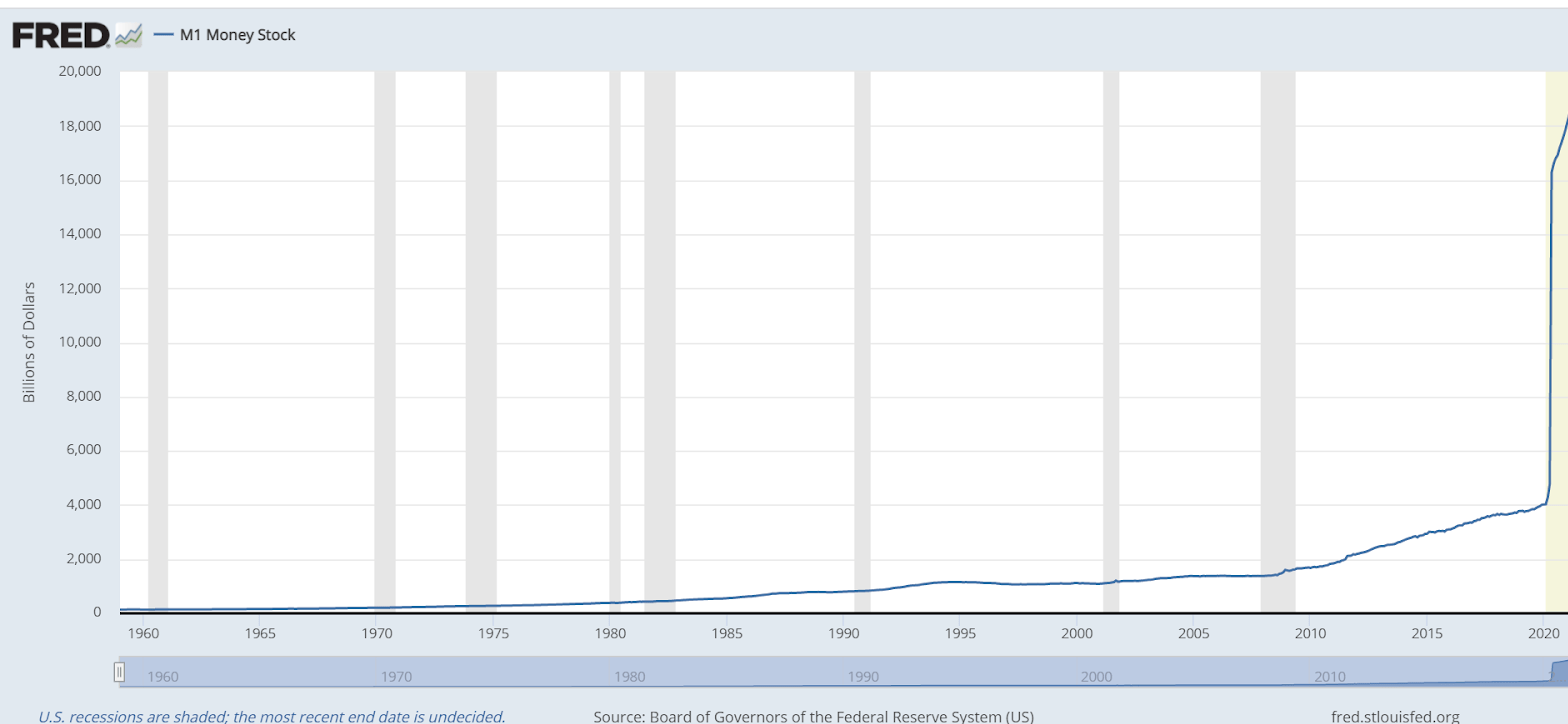

If we look at the money supply from the 2020 stimulus (see Figure 1), we see a sharp increase. Some economists are warning that the surging money supply may exacerbate a rise in U.S. inflation. This increase is more than the mid-pandemic requirements (demand-pull). We have seen increases in food, wood, and even the consumer price index (CPI) (cost-push), and workers are thus demanding more to return to work (built-in). The likely result of all three mechanisms existing simultaneously will be higher inflation.

Although many economists, including the Federal Reserve, are playing down this most recent inflationary surge as a pandemic causing supply chain disruptions, not everyone agrees with that. Some of it is most certainly transitory, but it’s hard to claw that back when people have their wages hiked. Also, the energy cost might be on a sustainable growth curve as the world tries to transition to renewables and reduce its carbon footprint.

Planning for Inflation

Cash is the worst thing to have in an inflationary period. Relatively mild inflation has been the prevailing trend for the last century in this country. Warren Buffett is fond of saying that the worst investment is cash because you are guaranteed to lose. Your purchasing power will decline over time due to inflation.

Expect prices to increase 3-5% a year for a while, and make sure your retirement plan can handle such an increase. Historically the Fed raises rates to combat inflation, so don’t get locked into a low-interest long-term investment (long-term bonds) and start looking for higher interest investment opportunities as they come up. However, do lock in lower interest loans now for mortgages and other large purchases. Stocks will likely outpace inflation; companies may initially be hit with higher costs, but their prices will match inflation as companies sell goods and services. If you are receiving Social Security, it may take a while for your cost of living (COLA) to increase to reflect inflation, so expect to pinch a few pennies for a short time.

As long as we plan for inflation, we can adjust our investments and lifestyles to handle it. Don’t hesitate to have this conversation with your financial planner. If you’re pondering this situation, whether to invest all at one, please feel free to reach out to me at Chase Thomas chtomas@alphawealthfunds.com and I’ll be happy to discuss it and possibly show you better strategies to accomplish your goals.