Financial bubbles have been a semi-frequent part of the economy for hundreds of years. The speculative nature of financial markets and an unhealthy amount of greed lead to unrealistic valuations of asset classes, which eventually creates financial bubbles and, in rare cases, a crash in the market.

Bubbles are only obvious in hindsight. While they are gripping the popular conversation, they are great investment opportunities. You can make a lot of money in the front end of financial bubbles and lose it all and then some in the inevitable reckoning. Some of the most notable financial bubbles have occurred in the last 100 years, starting in the 1920s.

Black Thursday

During the 1920s, there was widespread development in new industries like automobiles, radio, telephone, and more. This led to wild speculation, which drove stock prices to record highs. However, in the late 1920s, unemployment and decreased production led to a significant disconnect in the stock values and the companies’ actual worth. On October 24th, 1929, the stock market fell 9%, causing a mass panic that led to the worst bear market in modern history. By the end of the crash, stocks had lost nearly 90% of their value which was a major catalyst to the great depression.

One of the more memorable financial products of that era was Investment Trusts. They were first introduced in the U.S. around 1926, in the form of trading corporations, with the sole purpose of investing pooled capital into stocks. And like many new investment vehicles, it didn’t take long for them to become wildly popular with investors.

By 1929, roughly 640 trusts existed with about $4 billion in assets. In ’29 alone, trusts accounted for one-third of the $6 billion in new offerings — about $1 billion of that was estimated just in August and September alone. Yet, those numbers don’t really describe what was going on. One of the worst examples of investment trust excess was highlighted by John Kenneth Galbraith, who cited the wild speculation of Investment trusts as a contributing factor to the Crash of 1929.

Sound familiar? They sound a lot like the SPACs we hear almost daily about today. Please read this article we wrote back in November, foretelling the decline in most SPACs we see today.

Dot Com Bubble

The 1990s was remarkably similar to the roaring ’20s in that major technological advancements were achieved, and new industries were booming. The invention and integration of the internet was a major development to the economy that gave investors an overinflated sense of value towards tech companies, specifically those with a “.com” domain. Fundamentals were ignored, and valuations were based on pure speculation. This led to internet-based companies increasing in value by several hundred percent, leading to what would eventually be one of the largest sector crashes in history.

The Nasdaq composite index, mainly comprising tech stocks, reached its peak in 2000, up nearly 400% since 1995. By that time, many dot com companies ran out of capital and went bankrupt, which led to a mass selloff of other tech stocks. When the Nasdaq bottomed out in 2002, it had lost 78% of its value, and many companies did not survive.

Housing Bubble

The housing bubble began in the early 2000s when lenders started giving out subprime mortgages to borrowers with less than stellar credit. These subprime mortgages were then packaged and sold as investments called back mortgage securities. At the same time, home values were increasing to record highs and peaked in 2006.

Most of the subprime mortgages were ARMs (Adjustable-Rate Mortgages), starting with a small payment and later increased. This, in combination with a decline in home values in 2007, led to several of these mortgages defaulting. This caused mortgage-backed securities to drop significantly in value or even become worthless. Triple AAA credits in the CDO market proved to be illusionary. The result was a collapse in the financial sector, with many unprepared investment firms and banks going bankrupt in 2008. This caused a chain reaction that led to the overall crash of the economy known as the great recession, which led the stock market to decline over 30% while home values also dropped 40%, wiping out the retirement funds of many Americans.

Crypto- is it the next bubble? Perhaps the mother of all bubbles.

The crypto craze began with the invention of the first cryptocurrency, Bitcoin, in 2010. Over 7 years, Bitcoin increased nearly 2,000,000%. Most of that gain happened in 2017 when the price went from $700 to just under $20,000 in a matter of months. This price increase was based purely on speculation with no fundamentals to base on.

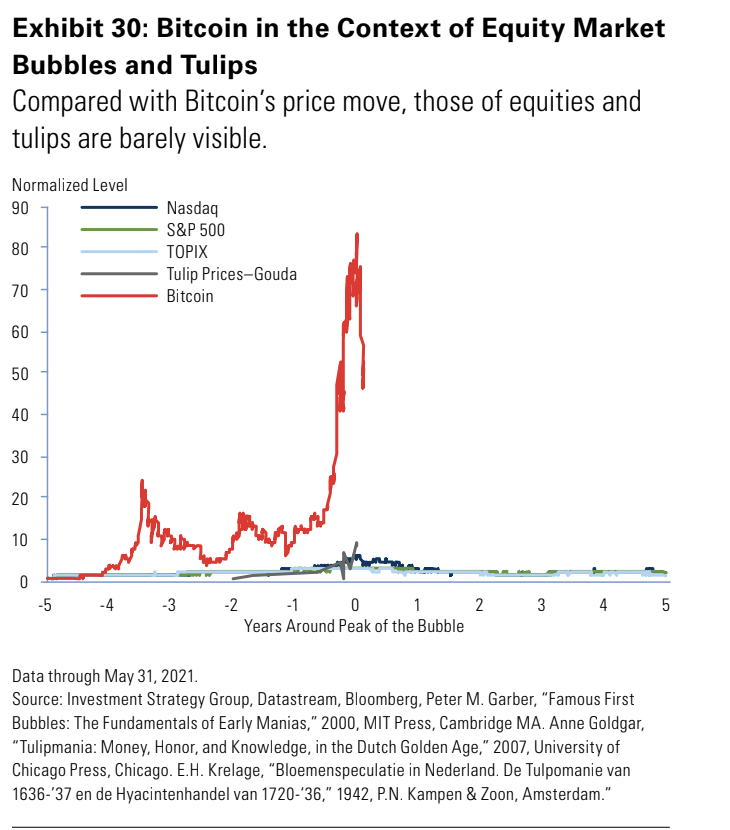

But In 2018, the price of Bitcoin crashed nearly 80% from its high, falling below $4,000, making it one of the biggest assets crashes in all of history. Since then, Bitcoin has broken new highs, and thousands of cryptocurrencies have popped up with major increases in value. Some argue that cryptocurrency is still in a bubble. But only time will tell. Goldman Sachs just published an exhaustive piece on Crypto and recommended that their clients shy away from this investment. The chart below is from that report.

Afterthought

Afterthought

While financial bubbles have been around for hundreds of years, they have become more frequent in recent times. Due to increased investor participation, several opportunities, and increased speculative markets, financial bubbles have been relatively common in the last 100 years. Let me know where the next bubble will be, and I’ll tell you how we can make a lot of money.

If you’re pondering this situation, whether to invest all at one, please feel free to reach out to me at Chase Thomas chtomas@alphawealthfunds.com and I’ll be happy to discuss it and possibly show you better strategies to accomplish your goals.