Over the past month, you have often come across headlines such as “The markets have lost 30% off their value”, “Dow finishes down to mark worst week since 2008”, etc. Marriott CEO said this is worse than 2008 and post 9/11 combined. All such headlines trigger an immediate reaction in the minds of the average investor – Where should I put my funds so that they are safe? Even perceived safe assets like investment grade bonds and municipal bonds are under severe distress.

Amidst high panic and fear, investors tend to sell off their positions in the stock markets at losses so that the volatility of the markets doesn’t bother them. However, this loss aversion attitude in the short term leads to significant losses in the long run. Statistics have borne out that risk aversion runs higher than the greed impulse. Some estimate that the pain of losing is twice as strong an emotion than the joy of winning. To cut down their losses, investors may end up making wrong investment decisions, which can have severe repercussions in future.

The stock markets are highly dynamic in nature. Every bull run leads to a bear market and there is a bull market waiting at the end of the bearish phase. Historically, the total duration of bull phase has been much higher than the bear phase. To earn profits in the stock market, the trick is to stay calm during periods of volatility. The key is to act decisively during downturns rather than being misguided by hysteria. When, the market does bottom- which it will, there will be no bell ringing the all clear.

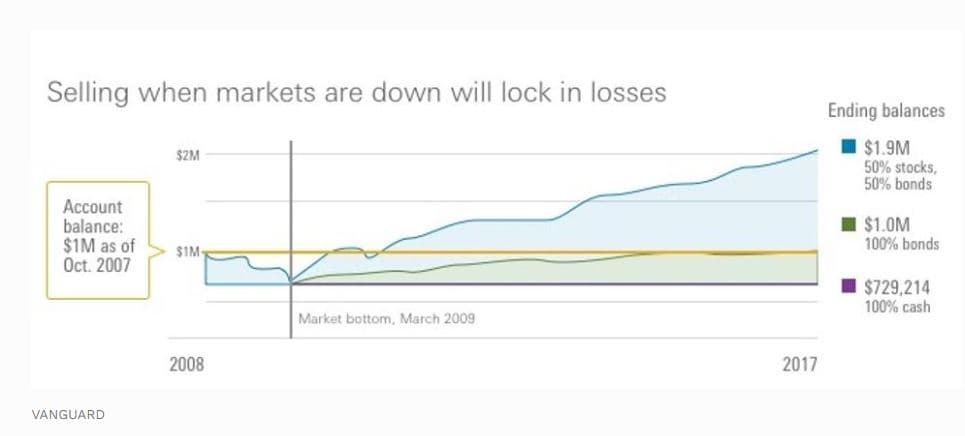

Vanguard conducted a study to find 10-year returns of investors who adopted different strategies during the last recession of 2007 – 2009. One investor chose to sell all holdings and put their cash into savings accounts. The second investor opted for bonds while the third investor continued to hold the 50-50 stock-bond portfolio.

The cumulative returns were the highest for the third investor with investments in stocks and bonds. The initial investment of $1 million grew to $1.9 million over the 10-year period, implying an aggregate return of 90%.

On the other hand, the first investor liquidated all holdings during the bearish phase. Over the 10-year period, the first investor incurred a net loss as the initial investment of $1 million was worth $729,214 only at the end. The first investor acted out of fear and incurred a net loss of 27% over the 10-year period.

Fear and panic interfere with the rational thinking and leads to decisions which can hurt significantly in the long run. Amidst volatility, the best action of an average investor is inaction. Staying calm during the bear phase would generate significant rewards in the long run. One way of keeping calmer is to have six months to a year of living expenses in cash so you don’t have to liquidate stocks or distressed bonds.

Some will choose an aggressive approach. In the words of the legendary investor Warren Buffett, “be fearful when others are greedy, and be greedy when others are fearful.” I wish I knew what Buffett was doing now. Of course, you can buy Berkshire Hathaway stock itself.

Another approach is to watch what insiders are doing with their own money. And they are buying. This is the highest level of insider buying to selling since 2008 but it has not reached that level yet. Since this current crisis is far worse, I’d wouldn’t wave the all clear until it exceeds that level. They may not have a better crystal ball about the Coronavirus than you or I, but they certainly have a better understanding of their business. That’s the basis of The Insiders Fund.

If you want to take a passive approach, investments in ETFs are also a good option. Many ETFs like the tech sector ETFs, energy sector and financial ETFs -even staid utility ETFs as well as broad market ETFs have witnessed substantial declines in price. So, start your research today. This is uncharted territory. No bear market every feels like it’s going to end, but they do- and sometimes violently to the upside.

What is important to realize is that all stocks will not march in lock stop with one another. For example, airline stocks during last Friday’s rout were mostly unchanged or even up. That’s a strong signal of a bottom in the group but one day in this new world is not sufficient enough to call a trend.