The Federals Reserve’s hawkish about-face with its monetary policy will do little to rein in inflation and potentially worsen it. It will certainly cause immediate harm to many people looking for employment in industries that are now shedding jobs due to rising interest rates. The root causes of this cycle of inflation have little to do with interest rate policy but are instead rooted in soaring energy costs and supply chain disruptions. Raising interest rates will do little to spur petroleum production or incentivize alternative energy projects. In fact, it will across the board make capital more expensive and the hurdle steeper for new investments in traditional or green energy.

No one has adequately explained the path, prepared the public, or adequately planned for getting off the hydrocarbon economy. Decades of offshoring vital technology and manufacturing to lower-cost countries cannot be reversed overnight. The folly of this decades-long industrial policy is now becoming apparent to both Democrats and Republicans alike. Walmart with its made-in-China manufacturing has imported deflation for decades. That has ended. Raising interest rates has nothing to do with changing that dynamic.

Certainly, there was excess money circulating in the environment as the Government tried to avoid an economic meltdown due to the uncertainties of the Pandemic but that sugar high is over and not likely to be repeated. That was the “famous transitory inflation” the Fed spoke of. Now with an abrupt turn about, more politically inspired than rationale, the Fed is falling victim to the bond vigilantes and the financial profiteers calling for much higher interest rates while they are betting billions on pushing the yield curve up. They are talking their own book and finally to our loss, the Fed is listening.

I would have thought we would have recognized the folly of Paul Volker when he drove interest rates up into the teens to tack an unprecedented about of inflation that was clearly caused by the Arab oil embargo that quadrupled the price of oil overnight. That policy was the economic equivalent of the medieval ages medical diagnosis of bleeding the patient to cure disease. Just flat-out stupid.

We live in an economy based on hydrocarbons and have been doing this for the last two hundred years. All of what we take for civilization is based on this, whether it’s heating or cooling your home or business, providing electricity, or transportation from one side of town to the other side of the planet. The world runs on hydrocarbons. It is the precursor key input cost across almost all industries, including agriculture and fertilizer. The rise in oil and gas will always cause inflation in a world built around it.

These are not discretionary purchases. No one buys oil or gas for entertainment. It’s a necessity of life and price inelastic. Trying to bring these costs down by raising interest rates is lunacy. I thought we had moved beyond that but clearly, after today’s Fed meeting, there are still economists that think Paul Volker was a hero. I think he was a stubborn fool. Just a few years later the price of oil collapsed and we began decades-long of declining inflation. Volker had nothing to do with it.

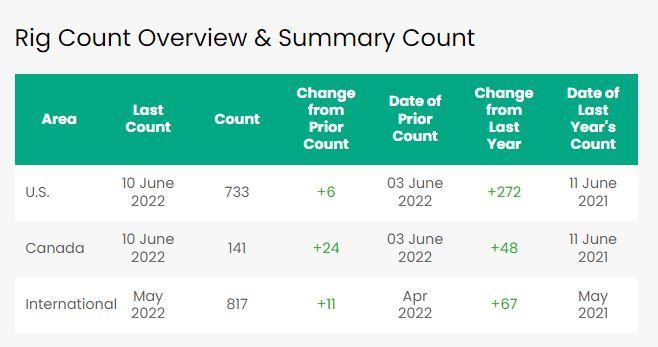

Based on this latest chart from Baker Hughes, good ole American capitalism is at work. The old saying in the oil industry is the cure for high prices is high prices. It begets more production. That’s what’s happening now according to Baker Hughes’ rig count. No doubt the Fed will take credit for tackling inflation once oil starts coming down due to the demand response. Nothing at all to do with Fed policy. If anything in spite of it. When will we ever learn?