Statisticians have long held out that people’s aversion to losing money makes them choose illogical or mathematically wrong choices when it comes to investing. I always thought dollar-cost averaging was a smart investment strategy until reading this article.

Dollar cost averaging means investing a fixed amount at fixed intervals of time. That’s a sensible approach, for example, if it means committing yourself to investing a fixed amount of your salary every month toward your retirement.

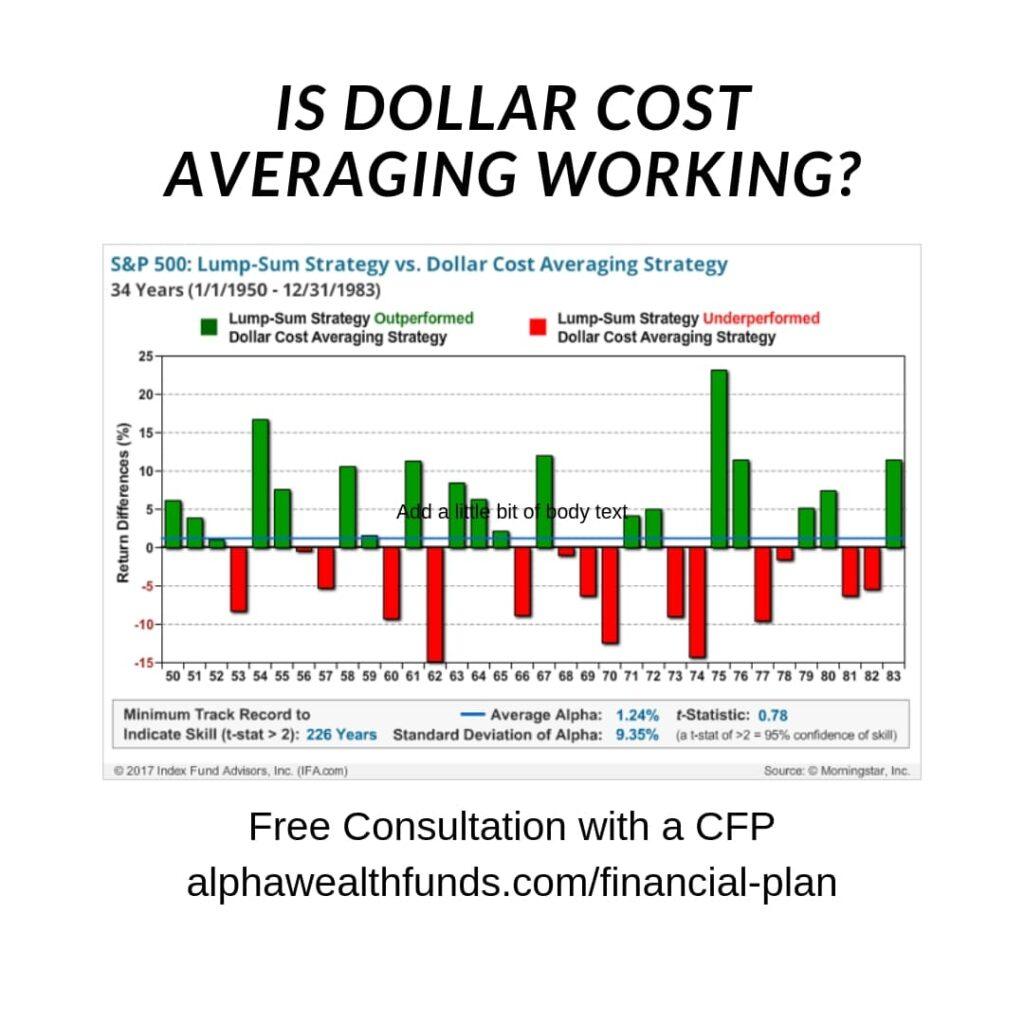

However, some people also think you should dollar cost average a lump sum. For example, if you had $12,000 that you wanted to invest in a stock index fund, they would tell you to invest $1000 per month over a year, rather than investing the whole amount immediately. The rationale is that market volatility should then work in your favor, because you will automatically be purchasing more shares when the price is low, and fewer shares when the price is high.

As appealing as that theory is, its advantage looks like a myth, as this calculator shows. It uses market data to let you compare dollar cost averaging with lump sum investing for the start date you specify.

#financialadvisor #financialadvisor #financialadvisors #financialadvisorcoaching #financialadvisory #financialadvisortips #financialadvisormarketing #financialadvisorlife #financialadvisorcoach #financialadvisorforlife #financialadvisorduties